Refinancing

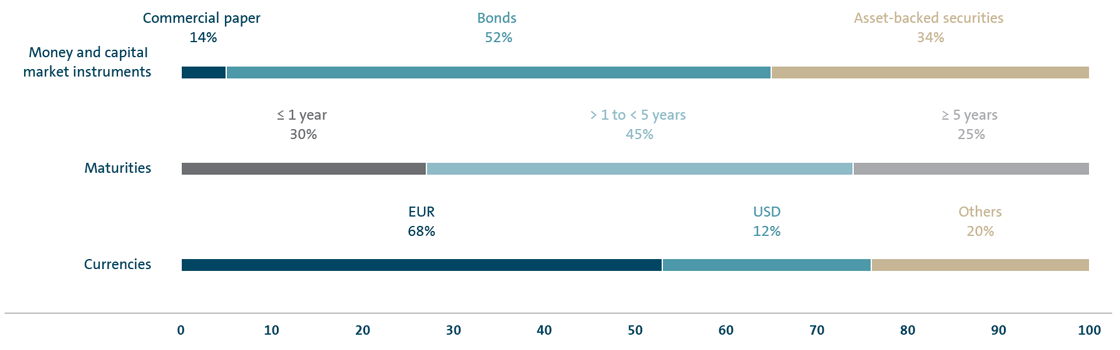

REFINANCING STRUCTURE OF THE VOLKSWAGEN GROUP

as of December 31, 2017

In the course of 2017, the Volkswagen Group was able to increase the number of bonds issued on various money and capital markets compared with the prior year. In particular, senior and unsecured bonds were issued again in Europe, where we successfully placed a benchmark bond for the Automotive Division for the first time since 2015. This had a volume of €8.0 billion. We were also active for the Financial Services Division in this market, issuing three benchmark bonds totaling €7.75 billion. In addition to this, we issued private placements.

In June 2017, we boosted net liquidity by placing unsecured, subordinated hybrid notes with an aggregate principal amount of €3.5 billion. The perpetual notes were issued in two tranches and can only be called by the issuer. One tranche with a volume of €1.5 billion can only be called after five and a half years, while the other tranche of €2.0 billion can only be called after ten years.

A further focus of refinancing was the issue of commercial paper, especially in Europe and in euros.

Asset-backed security (ABS) transactions were another important element of our refinancing activities, amounting to over €4.1 billion in Europe.

Bonds and ABS transactions were also issued in local capital markets, including Australia, Brazil, China, India and Mexico.

In addition, the Financial Services Division issued a public promissory note with a value of €0.9 billion.

The proportion of fixed-rate instruments in the past year was roughly twice as high as the proportion of variable-rate instruments.

In all refinancing arrangements, we pursue the goal of excluding risks related to interest rates and currency by entering into derivatives contracts at the same time.

The table below shows how our money and capital market programs were utilized as of December 31, 2017, and illustrates the financial flexibility of the Volkswagen Group:

| (XLS:)

|

|

|

|

||

PROGRAMS |

Authorized volume € billion |

Amount utilized on Dec. 31, 2017 € billion |

||

|---|---|---|---|---|

|

|

|

||

Commercial Paper |

36.3 |

15.0 |

||

Bonds |

127.6 |

58.1 |

||

of which hybrid issues |

– |

11.0 |

||

Asset-backed securities |

71.2 |

34.9 |

The €20.0 billion syndicated credit line for Volkswagen AG that was agreed with a banking syndicate in December 2015 was terminated in June 2017 as contractually agreed. After exercising an extension option in 2015, the syndicated credit line of €5.0 billion agreed in July 2011 was extended to April 2020. This credit facility remained unused as of the end of 2017.

Syndicated credit lines worth a total of €6.4 billion at other Group companies have also not been drawn down. In addition, Group companies had arranged bilateral, confirmed credit lines with national and international banks in various other countries for a total of €8.5 billion, of which €3.4 billion was drawn down.